HANDLING ALL JOB RELATED LEGAL ISSUES FIND OUT MORE CALL NOW

1-877-525-0700

FPI MANAGEMENT PAYCHECKS REPORT WRONG RATE OF PAY FOR OVERTIME RATES

FPI Management’s paystubs may have reported strange overtime

rates for numerous employees. The Employment Lawyers Group has

paystubs from one FPI Management employee who is reported to

have approximately 16 different overtime rates none of which

make any sense, or correspond to his hourly rate. A failure to

properly report rates of pay on paystubs lead to fines of

$100.00 per paystub. The statute of limitations for this theory

may only be one year so employees facing paystub errors should

take legal action immediately.

The Employment Lawyers Group is presently investigating just

how many employees received paystubs from FTP Management with

erroneous rates of pay. A putative class action has been filed

against FPI Management alleging they provided employees

paystubs with erroneous rates of overtime pay that did not

correspond with their rates of pay.

The group of persons who will be in the potential class action

for paystubs errors has been defined in the lawsuit to include

all persons, whether permanent, probationary, or temporary,

employed by Defendant FPI Management within the State of

California from January 2, 2017 to present who were furnished

inaccurate wage statements in violation of the requirements set

forth in California Labor Code Section 226(a) because the wage

statements failed to include the employee’s correct hourly

rates, including those for overtime and/or double time,

accurate gross and net wages earned, and the correct itemized

deductions for rental credits paid by Defendant FPI Management

as compensation in excess of the allowable limits under Wage

Order 5. Employees who were subjected to improper FPI rent

credits who worked for FPI before January 2, 2017 may be

members of the rent credit class in the lawsuit, but not

necessarily the part of the case dealing with improper

paystubs.

California Labor Code Section 226 requires employers to provide

all rates of pay for employees. This means their correct hourly

rate must be included on the paystub. It also means the correct

overtime and double time rates must be on the employee’s

paystubs. If a rate of pay has been changed due to a rent

credit or piece rate work the rate of pay must reflect those

unusual circumstances. Additionally, paystubs cannot report an

amount for a rent credit in excess of Wage Order 5’s

limitations discussed earlier in this article. The FPI

paychecks Employment Lawyers Group has reviewed show paychecks

illegally claiming the payment of the entire rent credit as

wages.

Karl Gerber and/or Brett Gunther are available to speak to any

FPI Management employee who has questions about the putative

class action that was filed including rent credits and paystub

issues. Wage and hour lawsuits are technical and so are the

variety of laws pertaining to employee wages. For these

reasons, and due to the prior lawsuits against FPI management

it is important to contact the Employment Lawyers Group and

give as much and as honest information about your employment as

possible so they can determine how you might be effected by the

present putative class action lawsuit they filed.

Allow the Employment Lawyers Group to view your paystubs in order to determine if your employer properly reported your rates of pay. CALL 310-842-8600

FPI MANAGEMENT LAWSUIT

The Employment Lawyers Group law firm, run by Karl Gerber

who has represented California since 1993, has filed a lawsuit

against FPI Management. The California lawsuit alleges FPI

Management required their employees to live on premises, and

enter into rent credit agreements. The rent credit agreements

assign values to apartments in excess of that which allowed

under California Wage Order 5. In other words, FPI Management

is taking a greater rent credit towards their employees’ wages

than allowed under California law.

Although there have already been several class action lawsuits

against FPI Management by their employees it does not appear

any of these lawsuits dealt with their improper rent credits.

Even if they did, the class periods in those lawsuits ended by

the latest in July of 2017. Although the lawsuit the Employment

Lawyers Group filed asks for a longer class period, it may be

limited to improper rent credits by FPI Management from July of

2017 to whenever the lawsuit is certified as a class action, or

preliminarily certified for settlement purposes if either of

those events occur.

The employees in the putative class action against FPI

Management include all California employees who worked for

Defendant FPI Management within the State of California from

January 2, 2014 to present and who were required to live

on-site at a property managed by Defendant FPI Management and

who received a rent credit in excess of the maximum allowed

under the Industrial Welfare Commission’s Wage Order 5. These

employees include property managers, maintenance employees, and

any other employees whose wages were reduced by rent credits in

excess of the limitations in Wage Order 5.

While earlier lawsuits against FPI Management only covered

nonexempt employees this particular lawsuit could cover exempt

employees who received illegal rent credits. If that is the

case the period of time the lawsuit can go back is all the way

back to January 2, 2014.

While Wage Order 5 allows rent credits of approximately $600 a

month for single employee residents, the employee who filed the

lawsuit was credited more than $2,000 for his apartment.

Instead of receiving more than $2,000 in wages he was provided

with an apartment he was forced to live in, and not paid more

than $1,500 a month in wages he worked for. While FPI

Management could have credited the employee’s wages less than

$600 a month they credited his wages more than $2,000 a

month.

Apartment managers and maintenance workers of FPI will be class

members in this lawsuit if the court certifies it as a class

action. Class action treatment for the lawsuit appears

appropriate because the same rent credit agreement was used for

approximately 500 employees, and a rent credit for more than

allowed by California law was taken.

Employees in the putative FPI Management class action for

improper rent credits may be able to obtain the amounts of rent

improperly taken from their wages. They may also be able to

obtain interest on these improper rent deductions. Several

additional penalties may also be obtained including $100 per

paycheck that improperly reports rent credits, and 30 days of

wages if the employee is no longer employed by FPI

Management.

Several legal theories have been alleged in the FPI Management

lawsuit. These different legal theories allow employees to go

back in time for wages and penalties for differing amounts of

time. For the rent credits the lawsuit seeks to go back three

to four years from January 2, 2018. Whether some of this period

is wiped out due to a prior class action that went through July

of 2017 is still unknown. Regardless, these practices continue

to exist so this lawsuit may lead to recovery into periods of

time well beyond prior class actions brought for the same legal

violations, for slightly different reasons.

If the Labor Workforce Development Agency does not investigate

this issue, the putative class action against FPI Management

will be amended to ask for Private Attorney General Penalties

which class members may be able to share in. The period of time

for Private Attorney General Penalties may be limited to one

year from the date of administrative exhaustion of these

penalties. The Employment Lawyers Group has already exhausted

administrative remedies for the FPI Management lawsuit.

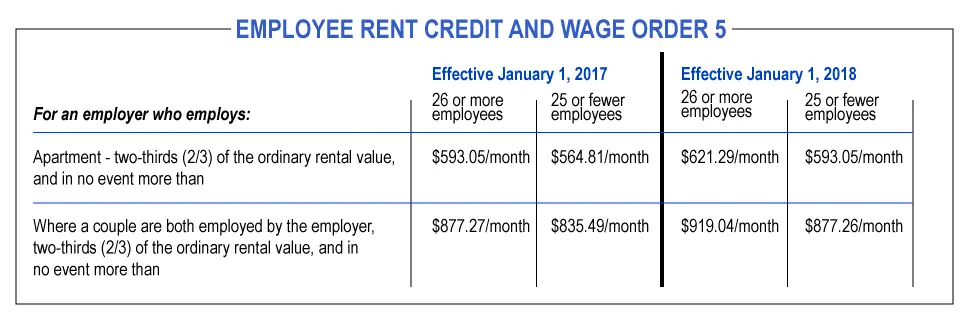

FPI MANAGEMENT EMPLOYEE RENT CREDITS

Wage Order 5 places maximum amounts an employer can credit towards wages they owe employees required to live on their premises, and employees not required to live on premises to the extent the rent credit is credited towards minimum wage that must be paid for every hour worked. For instance, highly paid residential managers earning $6,000 a month cannot have more than $621.29 charged as a rent credit if they manage an upscale 120 unit apartment building managed by an employer with 10,000 employees. In the case of minimum wage, an employee required to work 18 hours a week on premises cannot be paid nothing for those hours because they receive a $1,500.00 a month apartment. That employee would be entitled to at least minimum wage for each hour worked offset by $621.29-$593.05 a month if they were single.In 2017 employers who required their employees to live on their premises were prohibited from giving rent credits, against wages, in excess of $595.05 a month or $564.81 depending on how many employees the employer had if the employee was not a couple. Couples could not be charged more than $877.27 or $835.49 a month, against depending on whether the employer had more than 26 employees.

In 2018 employers who required their employees to live on their premises could not charge single employees more than $621.29-$593.05 a month for rent. Couples cannot be charged more than $919.04-$877.26.

The amount employers can charge their employees to

live on premises is based upon the number of employees the

employer has with 25 or fewer employees subjecting the employer

to the smaller figures and employers with 26 or more employees

being able to take the larger credit. If the employee is not

required to live on the premises, the employer’s rent credits

can only be credited against minimum wage for the amounts

listed above. All of the above credits cannot equal more than

2/3 the reasonable rental value of an apartment. For instance,

if the apartment is only worth $1,100 a month the employer

cannot receive $792.00 in wage credits from the employee even

if it is a couple who could otherwise be charged up to $919.04

a month.

The amount employers can charge their employees to

live on premises is based upon the number of employees the

employer has with 25 or fewer employees subjecting the employer

to the smaller figures and employers with 26 or more employees

being able to take the larger credit. If the employee is not

required to live on the premises, the employer’s rent credits

can only be credited against minimum wage for the amounts

listed above. All of the above credits cannot equal more than

2/3 the reasonable rental value of an apartment. For instance,

if the apartment is only worth $1,100 a month the employer

cannot receive $792.00 in wage credits from the employee even

if it is a couple who could otherwise be charged up to $919.04

a month.The Employment Lawyers Group has offices throughout Los Angeles including Bakersfield, Los Angeles, Sherman Oaks, Oxnard, San Diego, San Francisco, San Jose, Riverside, Tustin, Torrance, and Ontario. We have represented more than 500 individual workers in wage lawsuits, many thousands in class actions, collective actions, and Private Attorney General (PAGA) Actions in order to collect wages and/or penalties for employees. Please feel free to contact the Employment Lawyers Group if you have a question about wages owed to you regardless of whether FPI Management owes you the wages, or another employer.

ALTHOUGH THIS ARTICLE CONTAINS LEGAL INFORMATION IT CAN ALSO BE CONSTRUED AS AN ADVERTISEMENT FOR LEGAL SERVICES